SOLUTIONS - INVESTMENT MANAGEMENT

Extracting Alpha from an Ocean of Data

Our CargoMetrics Compass Platform brings leading maritime trade datasets and SaaS solutions to the Investment Management market. Its underlying foundation is fully systematic, with more than a decade of observations relating to maritime economic activity.

Alternative maritime data for investment management—built by an investment manager.

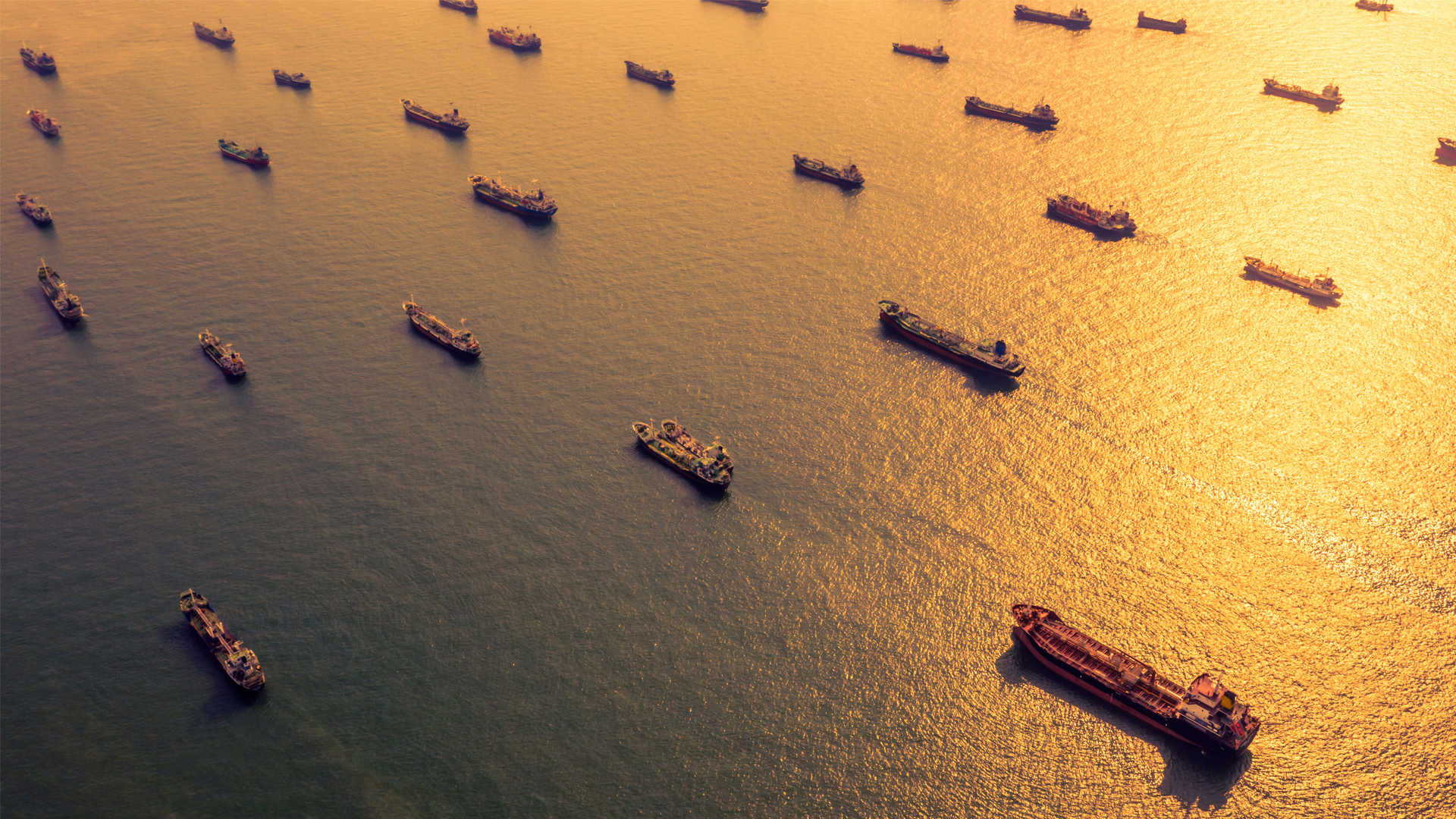

Our trade and commodity data products are built for quantitative research, trading, and analysis. Our rich history of data organized in a time-aware manner enables robust modeling and back testing. These products are used by financial analysts, researchers, traders, portfolio managers, economists, and other financial professionals at leading hedge funds, trading houses, commercial and investment banks, and multinational corporations.

Systematic, quantitative trading signals built from proprietary seaborne trade data.

Developed according to strict quantitative research standards, CargoMetrics’ Signals are uncorrelated, fully systematic forecasts of highly liquid commodity futures and FX markets. They are licensed by some of the world's leading quantitative hedge funds and can be combined with other signals in a client’s portfolio to enhance returns, increase capacity, and reduce risk.

Global maritime emissions, modeled.

The CargoMetrics Environmental Impact data products are designed to inform decision-making and improve visibility into the environmental impact of shipping. Our data and tools support both general and tailored emissions benchmarking and allow for the evaluation of decisions in terms of environmental impact — including carbon trading, vessel routing, speed, and equipment modifications.

Leverage our unique experience.

We engage in bespoke consulting, research, and software development service projects for companies in the Investment Management domain including those related to the construction of unique alternative datasets and research at the nexus of alternative maritime data and financial markets.

9+ years

out-of-sample trading history

40+ million

barrels of crude oil tracked daily

35+ commodities

tracked by our cargo algorithms

Featured

Enhancing investment research and trading with alternative maritime data

Hundreds of time series on commodity fundamentals and maritime economic activity with over a decade of history, designed for quantitative financial research and analysis, and the development of uncorrelated systematic trading signals.

Investment Management